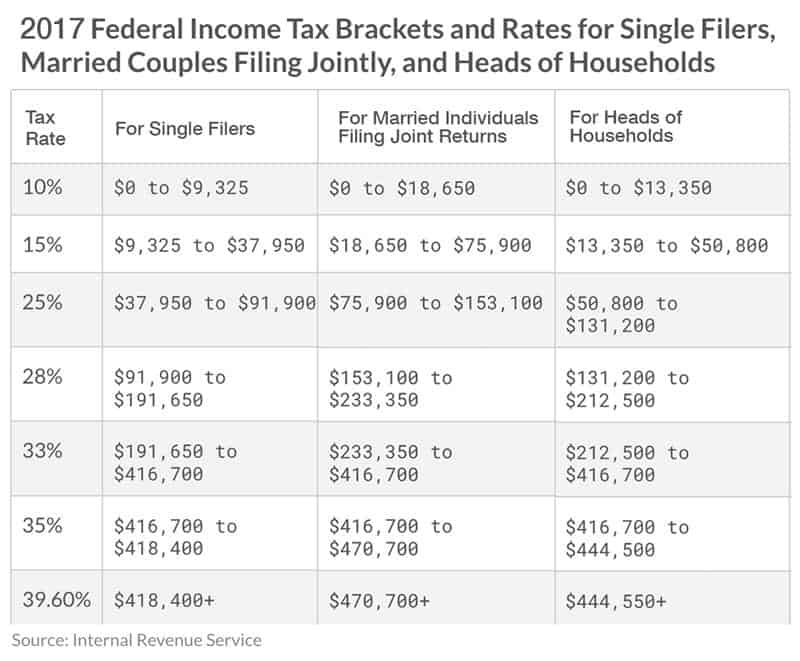

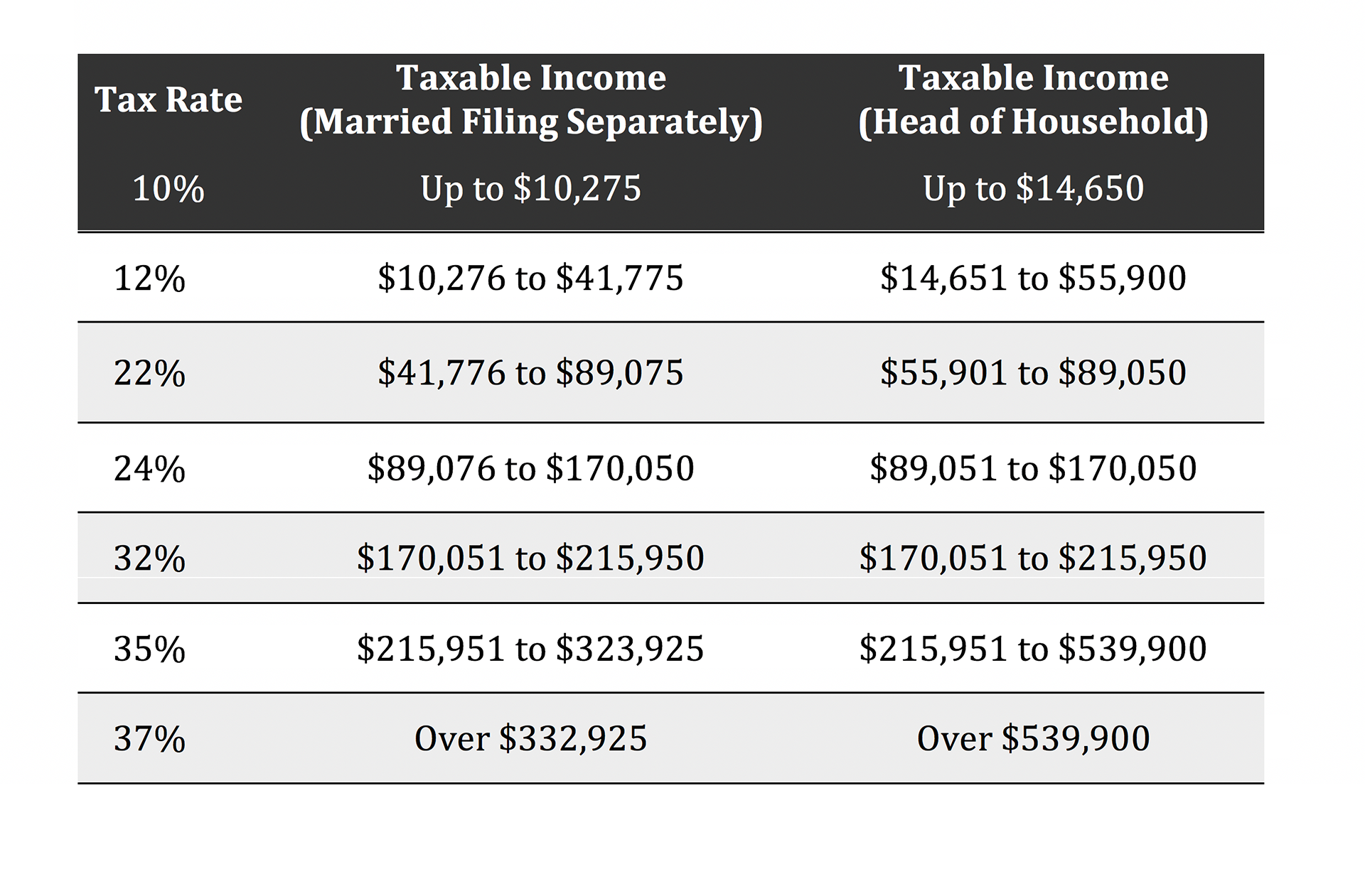

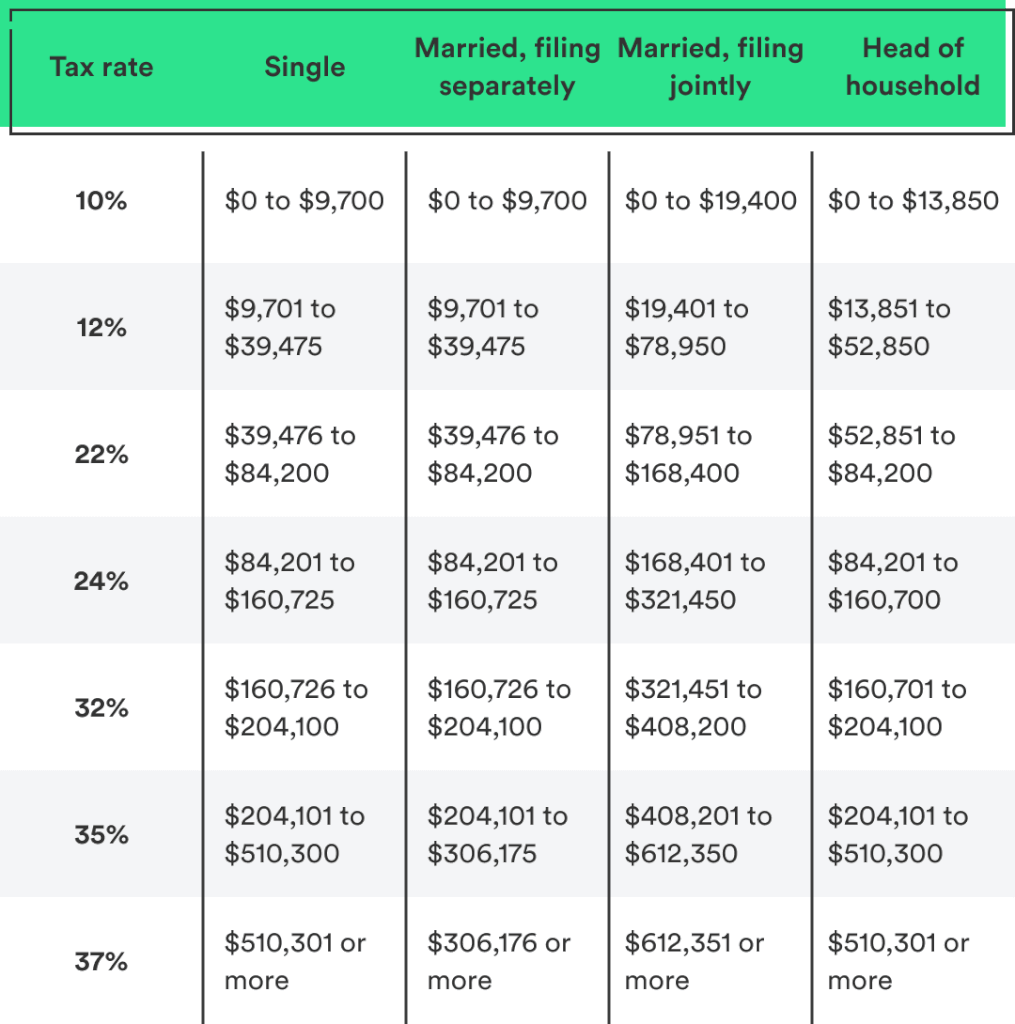

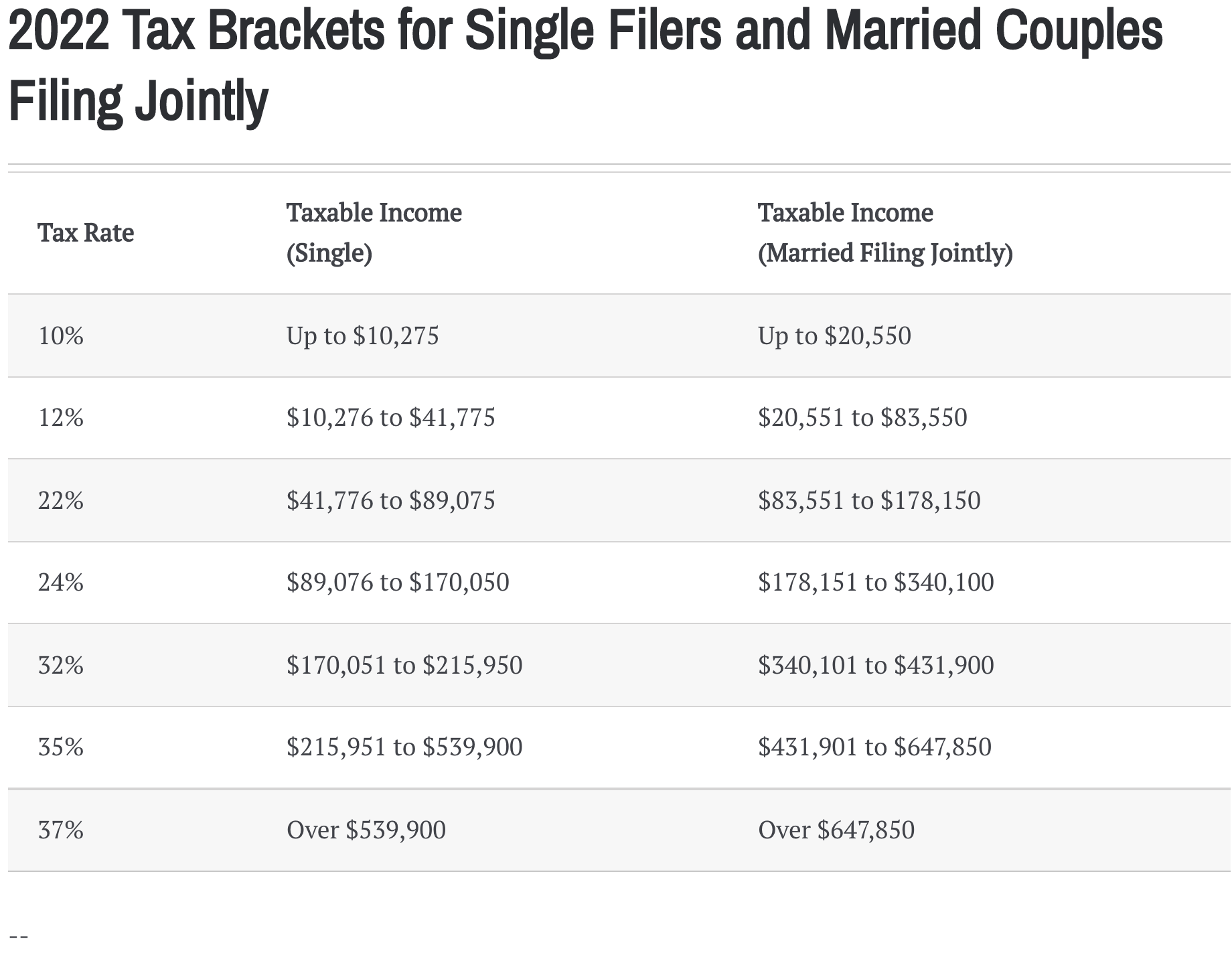

2025 Tax Brackets Married. Tax rate taxable income (married filing separately) taxable income (head of. 2025 tax brackets for married couples filing jointly and surviving spouses.

Here are the detailed 2025 federal income tax brackets based on the latest inflation adjustments: For 2025, the dollar limits used to determine the deduction under section 219(g) for active participants in certain pension plans are expected to be $79,000 for single.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, 37% for individual single taxpayers with incomes greater than $626,350 and for married couples who.

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Smith, Then we'll explore the new ideal income targets for single filers, married filers, and retirees.

Tax Brackets For Married Filing Jointly 2025 Lorrai Nekaiser, For 2025, the dollar limits used to determine the deduction under section 219(g) for active participants in certain pension plans are expected to be $79,000 for single.

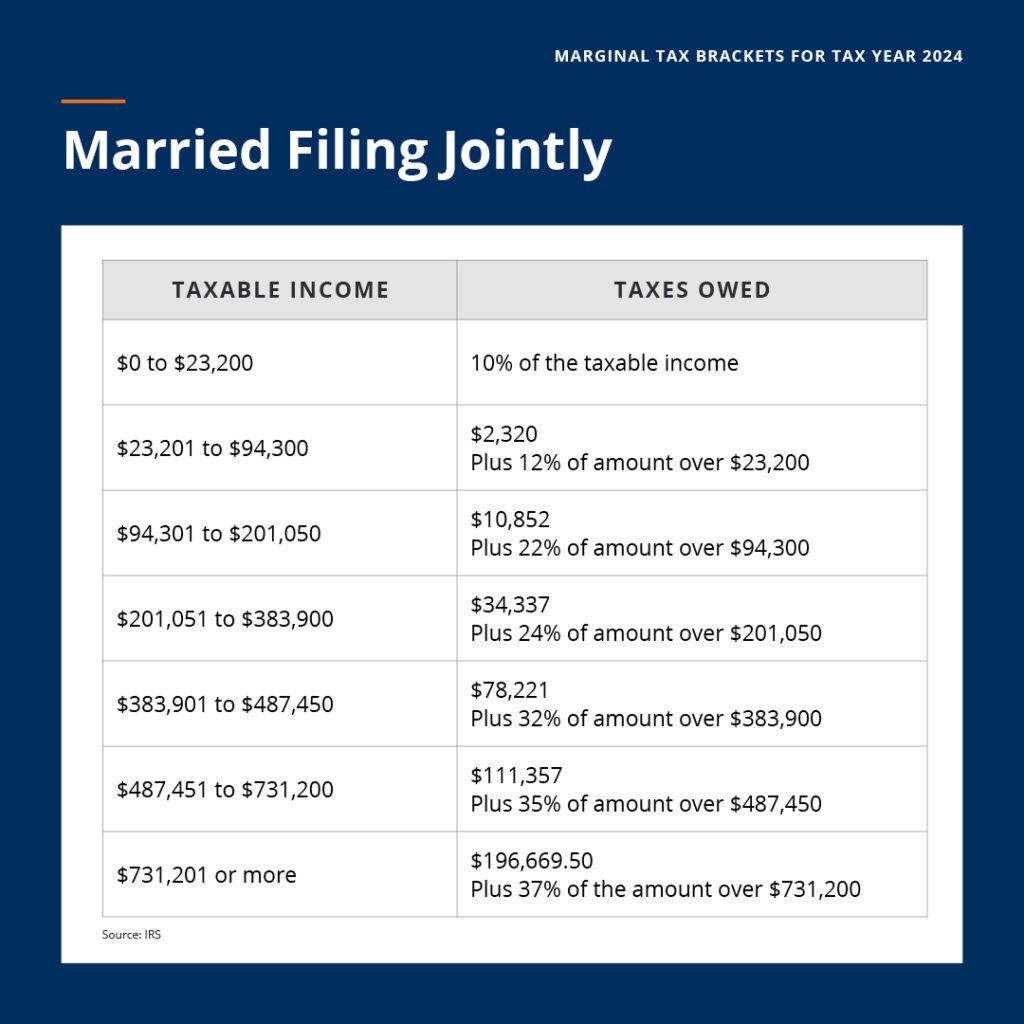

2025 Tax Brackets Married Filing Separately Single Harry Hill, The top marginal income tax rate of 37% will hit taxpayers with taxable income above $626,350 for single filers and above $751,200 for.

2025 Tax Brackets Married Jointly Married Anthony Ross, Calculate your personal tax rate based on your adjusted gross income for the 2025.

2025 Tax Brackets Married Filing Separately Single Jennifer Grants, 22% — $96,950 to $206,700;

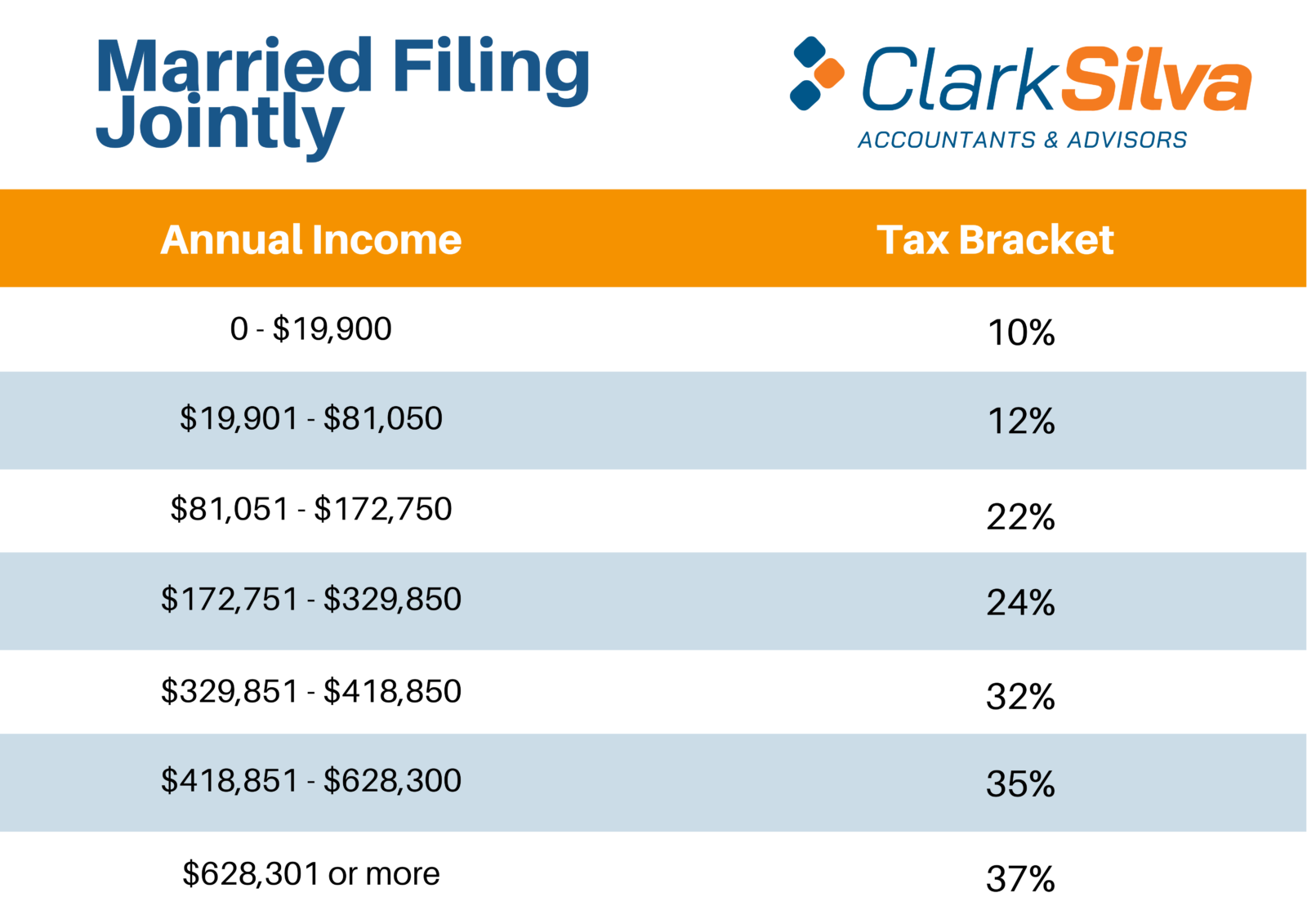

Tax Brackets Married 2025 Gilda Julissa, The tax brackets are divided into income ranges, and each range is taxed at a different percentage.

2025 Tax Brackets Single Over 65 Isaac Gray, The federal estate tax exclusion for decedents dying will increase to $13,990,000 per person (up from $13,610,000 in 2025) or $27,980,000 per married couple in 2025.

Us Tax Brackets 2025 Married Jointly Vs Separately Karen Arnold, For 2025, the dollar limits used to determine the deduction under section 219(g) for active participants in certain pension plans are expected to be $79,000 for single.

Tax Brackets 2025 Married Jointly Theo Adaline, The annual gift tax exclusion for 2025 is $19,000.