Auto Bonus Depreciation 2025. Now take 40% of the $24,000 basis to obtain the deduction. Please see our tax alert on the rev.

For 2025, the irs has increased the limits on how much. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of.

All taxpayers placing passenger automobiles in service in 2025 must use the limits in the tables below.

Lina purchased a new car for use in her business duri… SolvedLib, For more information, check out the. There’s still time to use this tax benefit!

Bonus Depreciation Definition, Examples, Characteristics, Phase down of special depreciation allowance. The legislation pending before the.

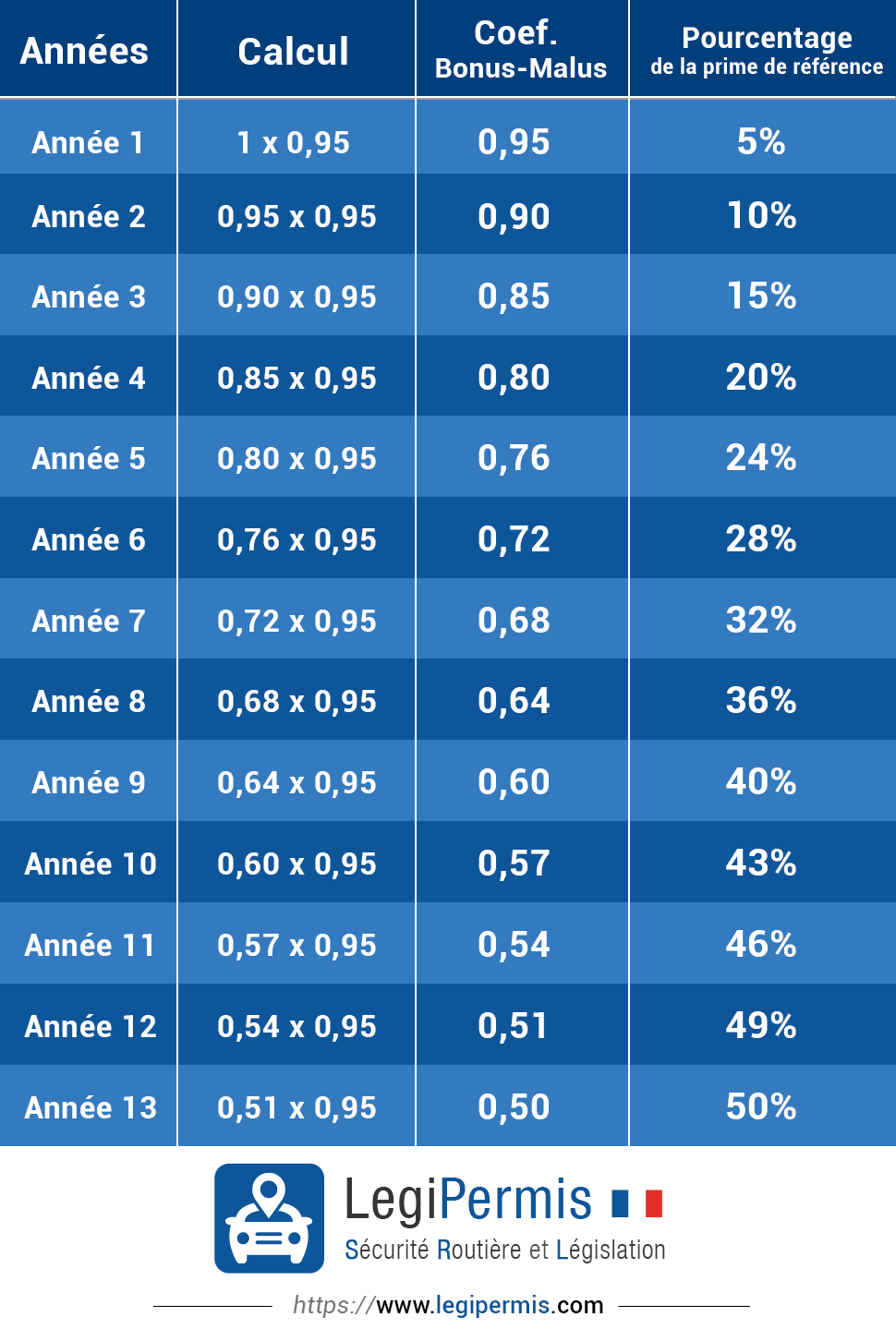

Unterschrift Verfolgung Gut ausgebildete calcul malus voiture, For suvs with a gvwr. Beginning in 2025, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

Temporary 100 “Bonus Depreciation” Decreases by 20 Per Year Starting, Depreciation is like the financial version of your car’s aging process. Beginning in 2025, the amount of bonus depreciation decreases by 20% each year until it phases out totally beginning in 2027.

The Multifamily Real Estate Experiment Podcast on LinkedIn Bonus, Bonus depreciation deduction for 2025 and 2025. The full house passed late wednesday by a 357 to 70 vote h.r.

Bonus Depreciation and Sec. 179 Expense What’s the difference? BMF, Depreciation is like the financial version of your car’s aging process. 20% this schedule shows the percentage of bonus depreciation that businesses can.

Luxury Auto Depreciation Caps and Lease Inclusion Amounts Issued for, This depreciates 20% in each subsequent year until its final year in 2026. All taxpayers placing passenger automobiles in service in 2025 must use the limits in the tables below.

Tax Alert Bonus Depreciation 2025 Phase Out, For more information, check out the. $19,200 for year 1 if bonus depreciation is claimed.

How to Qualify for Bonus Depreciation on a Rental Property Advanced, Prior to enactment of the tcja, the additional first. In 2025, bonus depreciation allows for 100% upfront deductibility of depreciation;

Changes to Depreciation Limits on Luxury Automobiles WFFA CPAs, For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of. For passenger automobiles for which sec.

All taxpayers placing passenger automobiles in service in 2025 must use the limits in the tables below.